Unleash the potential of your investment ideas

Test them. Break them. Refine them. Before the market does.

Fincanva turns risky guesses into proven strategies, because your investments deserve more than “maybe”.

Maximize returns, minimize risks

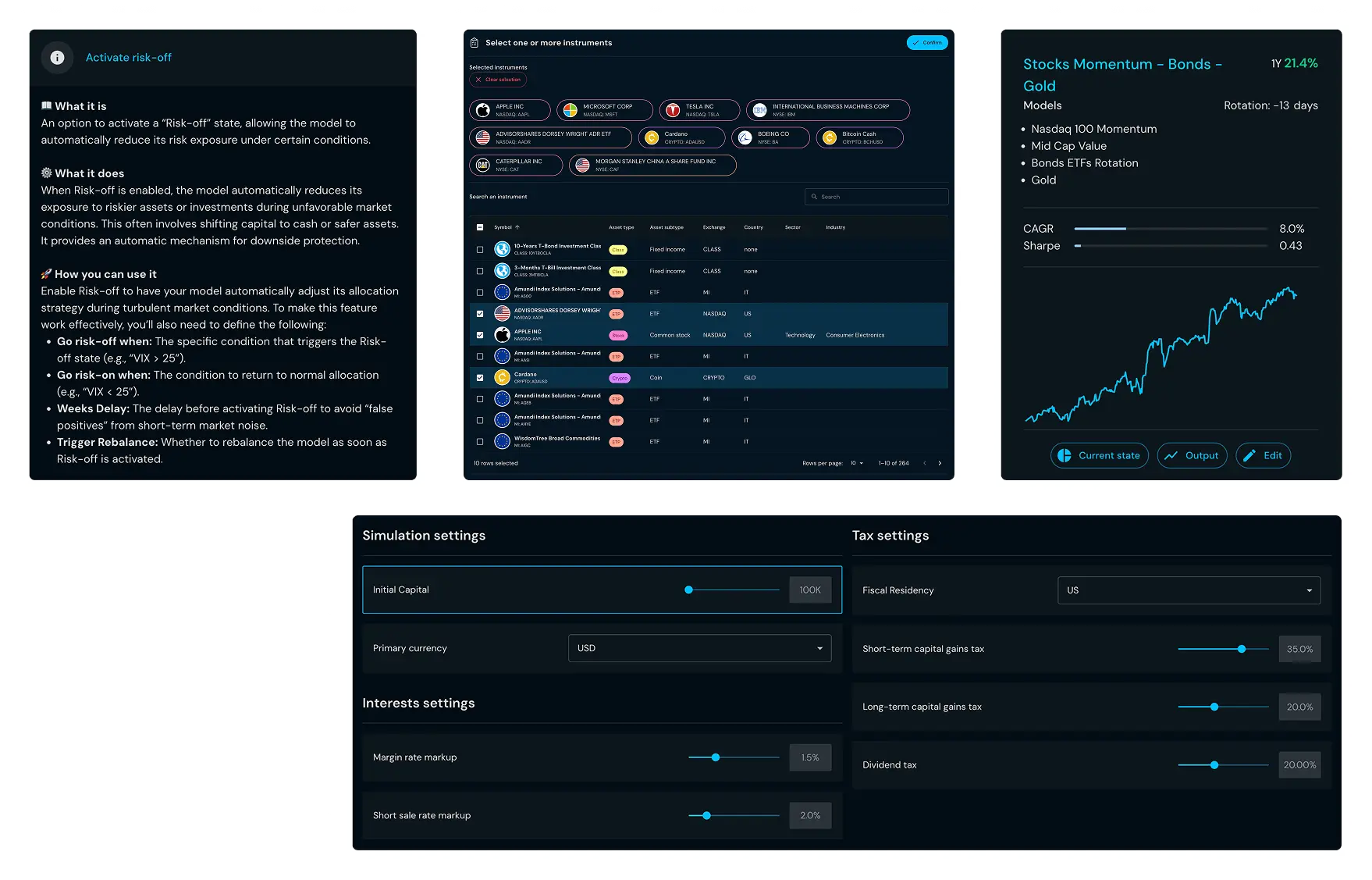

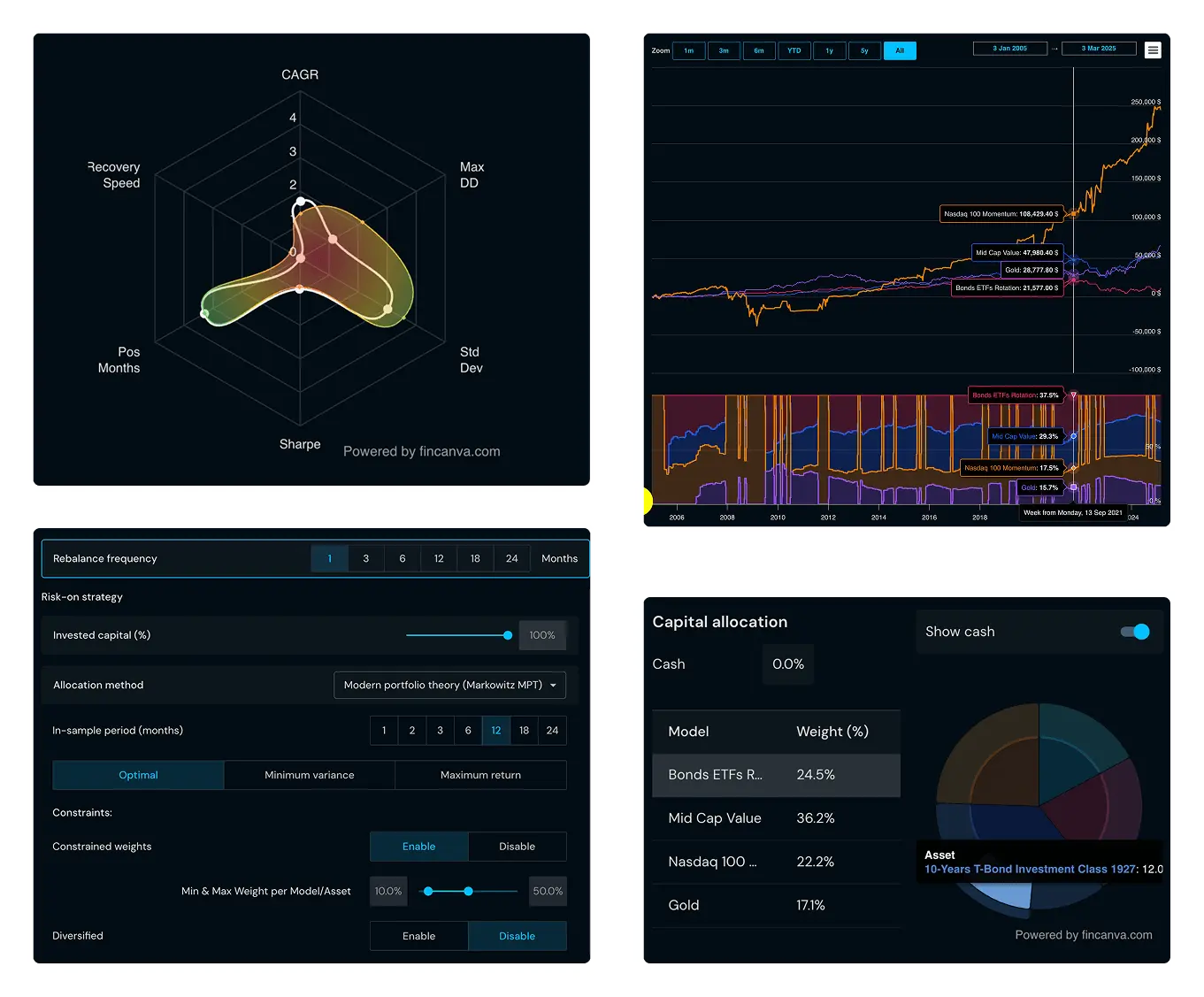

Screen for opportunities, test fundamental and technical ideas, and simulate real-world portfolio performance. Use adaptive risk logic to respond to market shifts, and fine-tune your allocations with data-driven confidence. No guesswork. Just clarity.

Simulate like the real world matters, because it does

Fincanva’s engine ditches the fantasy. We factor in costs, slippage, market noise, and biases to give you simulations that actually reflect reality. Test your strategies under real conditions, not ideal ones. Build confidence based on what works, not what “should have worked”.

Investing isn’t one-size-fits-all

Fincanva helps you design and test personalized investment models, because what worked yesterday might flop tomorrow. Simulate historical and real-time conditions, adapt your approach, and stay ahead of the curve with insight, not instinct.

Explore Fincanva’s comprehensive features

Fincanva is more than just a platform; it’s a comprehensive learning resource. Access a wealth of features, educational materials and market insights to deepen your understanding of financial markets and test investment strategies.

Empowering everyone through knowledge

Fincanva is a comprehensive financial education platform designed for everyone, from seasoned investors and financial professionals to academis and analysts. Whether you’re looking to take control of your financial future, refine your professional expertise, or delve into research, Fincanva is here for you.

Powerful, realistic, reliable

Fincanva’s simulations offer a cutting-edge approach to testing investment strategies. By eliminating common biases and incorporating real-world constraints, our simulations and backtesting provide a true-to-life representation of potential portfolio performance.

Learn, test, build, optimize

Fincanva empowers you to learn about portfolio management through hands-on experimentation. Test your strategies in a risk-free environment, build diversified portfolios, and continuously optimize your allocations. Track performance in real-time, rebalance effortlessly, and adapt to changing market dynamics.

Control risk. Maximize potential.

Fincanva’s cutting-edge risk management tools provide insights into the performance of various risk management strategies. Its backtesting capabilities allow studying and learning from historical data, thereby enabling you to make informed decisions to safeguard your investments.

Unmatched quality data for better Insights

Access a vast library of high-quality financial data, ensuring unbiased security selection and accurate backtesting. Fincanva’s comprehensive data includes historical listings and delistings, providing a complete picture of market dynamics since early 1900.

A platform crafted for every investment need

Fincanva delivers professional-grade investment tools for investors of all levels, making smart, data-backed strategies accessible to everyone.

Private investors

Fincanva helps you design and manage investments tailored to your goal. Get the data and guidance needed to build your financial journey.

Financial advisors

Create tailored investment solutions and enhance client relationships with powerful analysis and reporting features that showcase your expertise.

Academics & scholars

Bridge theory and practice in a risk-free environment where complex financial concepts come to life through real-world simulations.

Financial analysts

Analyze market insights with Fincanva’s analytics and data tools. Validate strategies to uncover opportunities and stay ahead in a competitive landscape.

Frequently Asked Questions (FAQs)

We're ready to answer

Have questions about Fincanva? We’ve got you covered! Here you can find some of the most commonly asked questions about our platform. If you don’t find what you’re looking for, feel free to reach out to us.

What is Fincanva?

Fincanva is a web-based Software as a Service (SaaS) for investing. It’s a risk-free sandbox where you can experiment, learn, and grow your investment knowledge. Whether you’re a seasoned investor or just starting, Fincanva provides the tools and knowledge you need to navigate the complexities of the financial markets and achieve your investment goals.

Who is Fincanva designed for?

Fincanva is a comprehensive financial education platform designed for everyone, from seasoned investors and financial professionals to students and researchers.

What is a portfolio in Fincanva?

A portfolio in Fincanva represents an overarching investment strategy designed to manage and achieve specific financial goals. It serves as a container for multiple investment models, each contributing a unique strategy within the portfolio. By combining different models, you can diversify your investments and manage risk more effectively. Think of a portfolio as a master plan that coordinates various models to create a balanced, goal-driven investment approach.

What is the difference between a portfolio and a simulation (or backtest) in Fincanva?

A portfolio is the actual investment strategy applied in real-time, guiding investment decisions. A simulation tests (or backtest) this strategy against historical data, allowing evaluation and refinement before implementation with real money. Simulations provide insights into portfolio performance under different market conditions, uncover hidden properties and relations, identify strengths and weaknesses, refine strategies, and build confidence in investment approaches.

What features are included in Fincanva’s free plan and trial?

Fincanva’s free plan gives you permanent access to powerful tools, including screeners, data exploration, and basic portfolio creation and simulations.

You can start building and testing strategies right away, at no cost and with no time limits.

If you want to explore advanced features like full backtesting, detailed reporting, and enhanced analytics, you can activate a 30-day free trial of any paid plan, no credit card required.