If you’ve ever searched for a simple investment strategy, you’ve likely encountered Lazy Portfolios. The idea is beautifully simple: pick a few asset classes, give them fixed percentages, and never touch them again. But while Lazy Portfolios were once the gold standard for passive investors, the market dynamics supporting them are changing.

Why Lazy Portfolios Worked So Well

Lazy Portfolios became legends for a reason. They gave regular investors access to diversification without needing to think too much.

Some of the classics:

| Boglehead | Permanent | All Weather | Golden Butterfly |

| Jack Bogle’s no-nonsense mix of stocks and bonds. | Harry Browne’s mix of stocks, bonds, gold, and cash. | Ray Dalio’s famous hedge-fund-inspired recipe. | A more balanced twist of equity, bonds, and gold. |

| 70% Global Equities30% Bonds | 25% US Equities25% Long-Term Bonds25% Gold25% Cash | 40% Equities30% Long-Term Bonds15% Mid-Term Bonds7.5% Commodities7.5% Gold | 20% Large Cap Equities20% Small Cap Equities20% Long-Term Bonds20% Short-Term Bonds20% Gold |

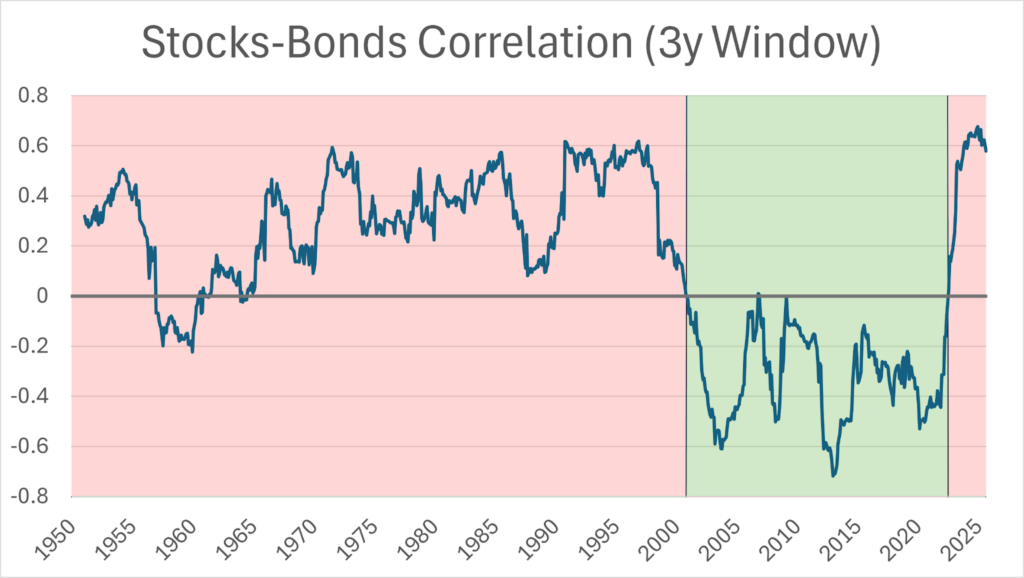

For nearly two decades, these static allocations worked beautifully. Why? Because one crucial relationship held steady: stocks and bonds were negatively correlated. When stocks fell, bonds often rose, softening the blow.

That made these portfolios resilient in crises, keeping drawdowns relatively contained, usually no worse than -10%, except for the 2008 meltdown.

Why the Strategy for Lazy Portfolios is Changing

But here’s the uncomfortable truth: the market backdrop that allowed Lazy Portfolios to shine has changed.

– Correlation has flipped: Stocks and bonds now often move in the same direction.

– Bigger drawdowns: Instead of -10%, static portfolios can now easily face -20% drops.

– Volatility is stickier: Inflation shocks, policy shifts, and global events keep shaking traditional safety nets.

Correlations between stocks and bonds stayed negative for over two decades (2000–2023). Today, that relationship has flipped back into positive territory, undermining the core assumption behind Lazy Portfolios.

The takeaway? What worked during their “golden age” may no longer shield investors in the same way. This doesn’t mean Lazy Portfolios are doomed, but it does mean the risks are now being underestimated by most people.

Lazy Isn’t Dead, But It’s Different

Does this mean you should throw away the Golden Butterfly or the All Weather Portfolio? Not at all. They’re still far more sustainable than chasing single stocks or crypto fads.

But on their own, they’re no longer sufficient. A purely static mix assumes the world never changes, and we know it does. The solution is to bring some level of adaptability into your portfolio structure. In the next articles, we’ll explore how dynamic portfolios can better withstand the constantly shifting landscape of financial markets.

How to Backtest Lazy Portfolios with Fincanva

This is exactly where Fincanva helps modern investors. Instead of asking “Should I still use a Lazy Portfolio?”, you can:

– Simulate classic Lazy Portfolios across decades, even centuries, of data.

– See how drawdowns have evolved as stock–bond correlations shifted.

– Experiment with adaptations — like adding momentum, risk management, or dynamic allocations, to make them fit today’s environment.

Lazy Portfolios had their golden age. With Fincanva, you can test whether they still belong in your future, and, if so, how to upgrade them.

Final Thought

The golden age of Lazy Portfolios taught investors a powerful lesson: simplicity works. But markets evolve, and what was once a shield can now feel more like a blunt instrument.

The next era of investing isn’t about abandoning simplicity — it’s about combining it with adaptability. And that’s where tools like Fincanva let you bridge the past with the future.