Predicting Stock Outperformance in a Crowded Market

Investors face a simple problem that is rarely discussed in depth: there are thousands of stocks in the market, but only so much time and attention to allocate to rigorous investigation. In this article, we explore a data-driven, facts-based approach for predicting stock outperformance designed to tilt the odds in our favor by narrowing a broad investable universe down to a manageable shortlist of high-potential candidates.

A common method for identifying these candidates is the use of stock screeners, which allow investors to filter equities using various technical and fundamental criteria. However, the challenge lies in the quality of the filters themselves; it is not always clear whether a specific filter actually works in our favor. A poorly designed screener might consistently select stocks with a tendency to underperform, effectively sabotaging the analysis before it begins. What we need are screeners that are, at minimum, neutral, and ideally provide a statistical tailwind to our portfolio. In the following sections, we present a screener and its rationale, outlining a framework for predicting stock outperformance that any investor can replicate.

Designing a Quantitative Framework

The framework presented here is quantitative in nature and relies on backtesting to evaluate the historical behavior of a specific screener. While we are working with historical data—and must remember that past performance does not guarantee future returns—simulations remain a powerful tool for predicting stock outperformance by understanding the statistical probability of a strategy’s success.

For this analysis, I utilized Fincanva.com, an extensive simulation sandbox that allows investors to test financial models and stock screeners in a safe, data-driven environment. To ensure our results are robust, we cross-validated the screener against major U.S. stock baskets, including the S&P 100, S&P 500, S&P 400, S&P 600, Nasdaq 100, and Russell 2000. These baskets were reconstructed with actual listed and delisted historical constituents to ensure the data remains as accurate as possible for anyone predicting stock outperformance.

Pitfalls to Avoid: Survivorship Bias

When simulating any investment method, several pitfalls must be avoided to maintain the integrity of the results. The most critical issue in screener backtesting is survivorship bias; a simulation must include stocks that were delisted or went bankrupt, rather than focusing solely on today’s “survivors.” To obtain meaningful insights for predicting stock outperformance, the simulation environment must mirror the actual historical environment as closely as possible, reconstructing the investable universe exactly as it existed at every point in time. The platform used for this research accounts for these factors, providing a realistic foundation upon which we can build our selection logic.

From Fundamentals to Factors

Stock screeners are often used to identify companies that already display obvious signs of quality. However, the reality of market competition means that if a company’s quality is apparent to everyone, it has likely already been priced in. As simulations repeatedly demonstrate, “common-sense” selection methods often underperform because markets reward anticipation rather than mere confirmation.

Our goal is to identify indirect signals that anticipate quality before it becomes evident to the broader market. In designing the screener for predicting stock outperformance, we focus on three strategic pillars: sustainable growth (recent revenue expansion), financial solidity (indirect signs of growth stability), and operational efficiency (metrics reflecting management effectiveness).

The “Confident Growers” Model

Our first filter focuses on Structural Strength by identifying companies that have proven their ability to increase revenue. Sustained revenue growth is the first tangible indicator of a solid business model and expanding demand, reflecting a company’s capacity to gain market share and improve margins. To capture this, we use the following metric:

Sales per Share (TTM) Growth (6 Quarters) > 10%

This ensures we are looking at companies whose annual revenue has increased by at least 10% over the previous year and a half. To assess the sustainability of this growth, we look for Confidence and Discipline through management behavior. When leadership perceives growth as durable, they often return capital to shareholders. We use dividend growth as a leading indicator of financial solidity, as increasing a dividend requires a genuine belief that future cash flows are resilient. This leads us to our second core metric for predicting stock outperformance:

Dividend per Share Growth (4 Quarters) > 5%

Finally, we evaluate Capital Productivity to measure how effectively management uses assets to generate revenue. Operating efficiency reflects both business scalability and management acumen, which is especially relevant when we are looking for leaders who can intelligently allocate resources. We conclude our logic with:

Asset Turnover (TTM) – Highest 10

This final filter narrows our selection to the top 10 most efficient stocks within our filtered universe.

Managing Risk

Before finalizing the screener, we must address three primary risks: market capitalization, dividend sustainability, and cash flow. To avoid the volatility of very small companies, we filter for a market cap above $100 million. To ensure dividend increases aren’t a sign of desperation or unsustainable payout policies, we exclude companies with a dividend yield above 5%. While we don’t add a specific hard filter for cash flow in this model, it is a variable investors should keep in mind as an extra layer of prudence for predicting stock outperformance.

The Completed Screener Logic

-

Market Cap > 100M

-

Dividend Yield < 5%

-

Sales per Share (TTM) Growth (6 Quarters) > 10%

-

Dividend per Share Growth (4 Quarters) > 5%

-

Asset Turnover (TTM) – Highest 10

Results: Predicting Stock Outperformance

To evaluate the efficacy of the “Confident Growers” model, we first applied the screener to the historical constituents of the S&P 500. The simulation ran from January 1st, 2000, to the present, re-executing the screener and updating the portfolio on a monthly basis. Specifically, the screener was executed on the first Friday of each month, with the portfolio updated at the market open on the following trading day. Below, the resulting equity curve is displayed on a log-scale for clarity; the blue line represents our screener-based portfolio, while the white line represents the S&P 500 Total Return Index benchmark.

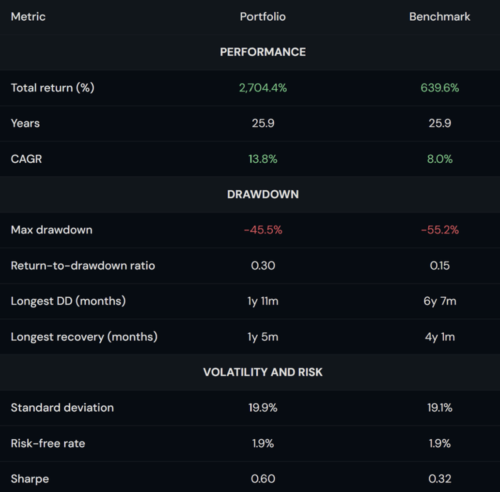

The strength of this approach is further evidenced by the core performance data. As shown in the following metrics table, the strategy successfully isolated stocks with superior return profiles within the index.

Cross-Market Validation

With a CAGR of 13.8%, a Maximum Drawdown of 45%, and a Sharpe Ratio of 0.60, the screener demonstrated a consistent ability to select stocks from the S&P 500 that later went on to outperform their starting basket. To cross-validate this ability in predicting stock outperformance, we expanded our scope to the largest investable universe available: the entire U.S. equity market. The resulting equity curve confirms that the strategy’s logic remains robust even when applied to thousands of additional securities.

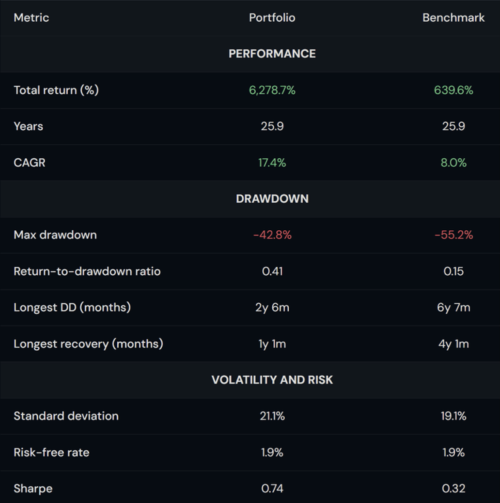

Detailed performance metrics for the broader U.S. market highlight how the filters scale across different market conditions and capitalizations, maintaining a significant statistical advantage over the market average.

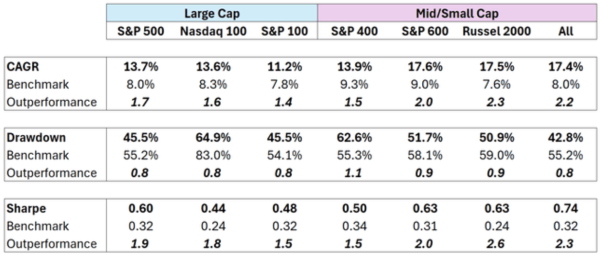

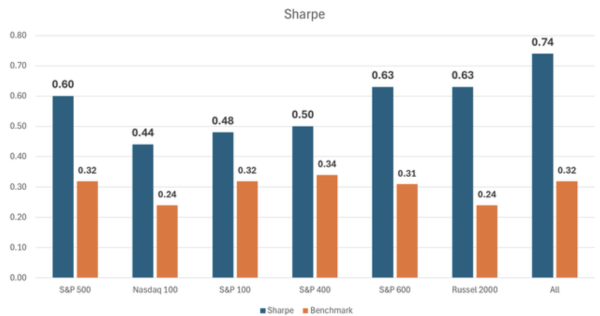

Beyond the broad market and the S&P 500, we extended our simulation to other key baskets, including the Nasdaq 100, S&P 100, S&P 400, S&P 600, and Russell 2000. The summary of these results, compared against their respective Total Return Index benchmarks, illustrates the high hit rate of the screener across various sectors and company sizes.

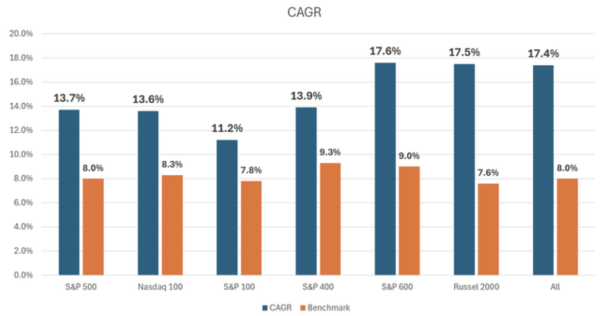

A visual comparison of the Compound Annual Growth Rate (CAGR) across these various baskets reveals a clear pattern of outperformance. Whether applied to blue-chip technology stocks or small-cap value plays, the strategy consistently yielded a higher growth rate than the benchmark.

Furthermore, looking at the Sharpe Ratios across these same baskets confirms that this outperformance was not merely the result of taking on excessive risk, but rather a reflection of superior risk-adjusted returns.

What we notice is a clear tendency to consistently select high-performing stocks regardless of the basket to which the logic is applied. This consistency is the hallmark of a successful cross-validation, suggesting that the “Confident Growers” screener is a robust tool for investors interested in predicting stock outperformance.

Conclusion

While a screener can serve as a standalone method for stock picking, its greatest value often lies in its ability to highlight stocks for deeper investigation. By building a framework based on sound fundamental principles—growth, dividends, and efficiency—we have developed a tool that has consistently proven its capability to find quality stocks across diverse market conditions.

Ready to find your own “Confident Growers”?

Stop guessing and start testing. Replicate the “Confident Growers” model or design your own custom screener using our professional-grade simulation sandbox.