The question of return vs sustainability in investing defines how long your portfolio can truly survive.

When investors talk about performance, the conversation almost always drifts toward one thing: returns.

- “How much did it make last year?”

- “Did it beat the S&P 500?”

- “Is Bitcoin finally back?”

Returns are shiny. They’re easy to show off and even easier to obsess over. But here’s the catch: if you only chase returns, you often lose sight of the other side of the equation: sustainability. And that’s where portfolios quietly fall apart.

The Return Trap

Imagine you’re hungry for growth. What’s the move?

- Buy an ETF on the S&P 500.

- Go all-in on an individual stock, like NVDA.

- Buy Bitcoin.

All three can deliver spectacular returns. But they can also knock you flat.

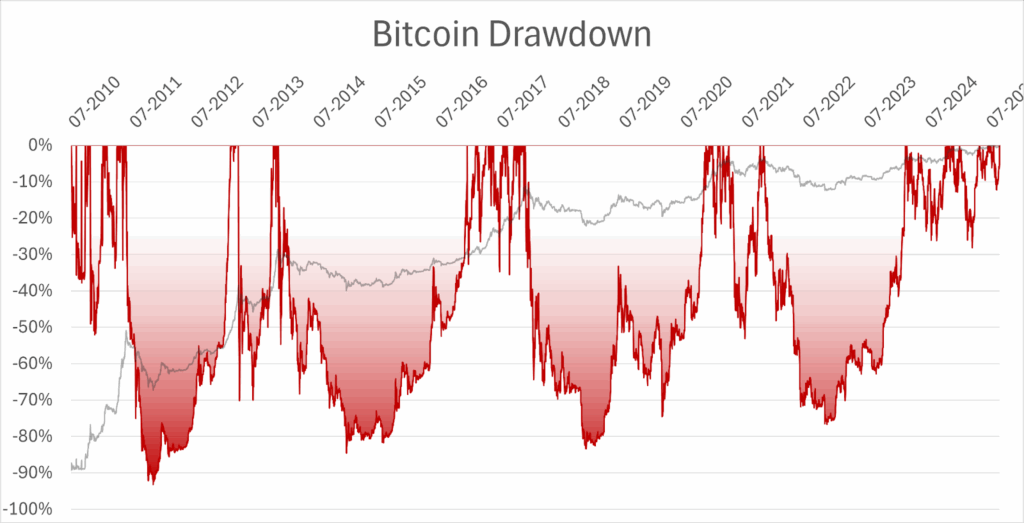

Example: Bitcoin has repeatedly suffered catastrophic drawdowns: -94%, -84%, -84%, -77%. If you invested $10,000 at the wrong time, you’d be left with a few hundred dollars during the worst stretches. Many investors panic-sold right there, locking in disaster.

That’s the problem with chasing returns in isolation. You get the climb… until gravity hits.

👉 Learn more about how Fincanva’s simulation engine tests portfolio resilience before risking real money.

Why Sustainability Matters More Than You Think

By sustainability, we’re not talking about ESG labels. We mean something brutally simple: can your portfolio survive the storm without blowing up?

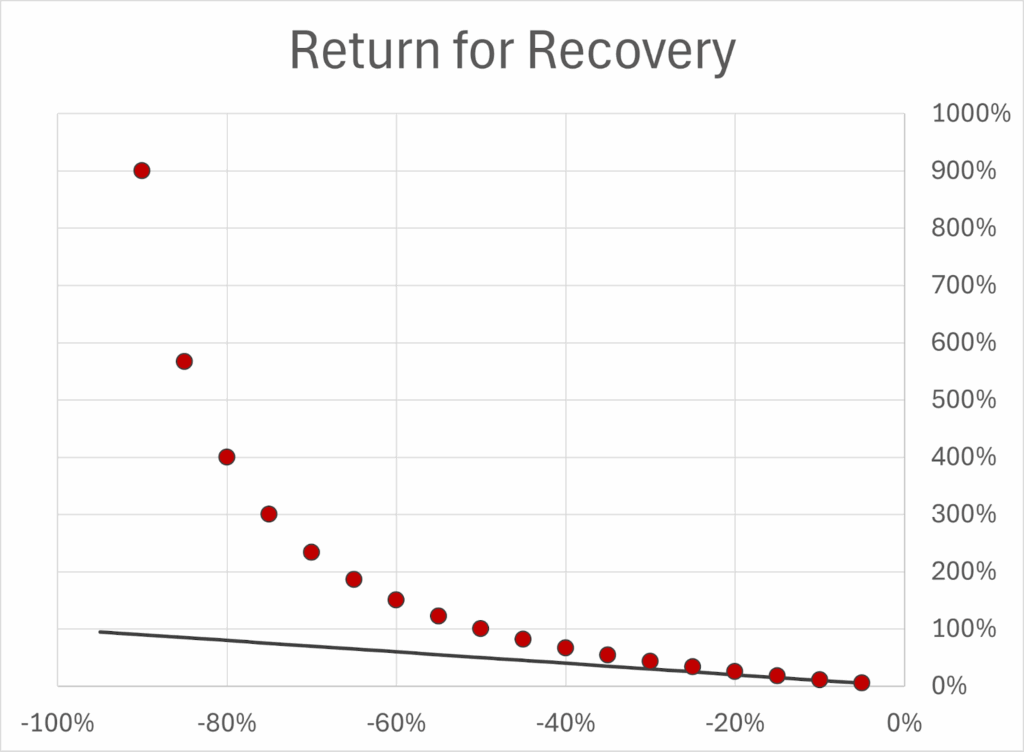

Because if your portfolio crashes by 90%, you don’t need +90% to recover. You need +900%. And that’s not just unlikely, it’s almost impossible.

The following chart shows the return you need to recover from a given loss. The black line is the -45° line, showing the size of a return equal to the given loss.

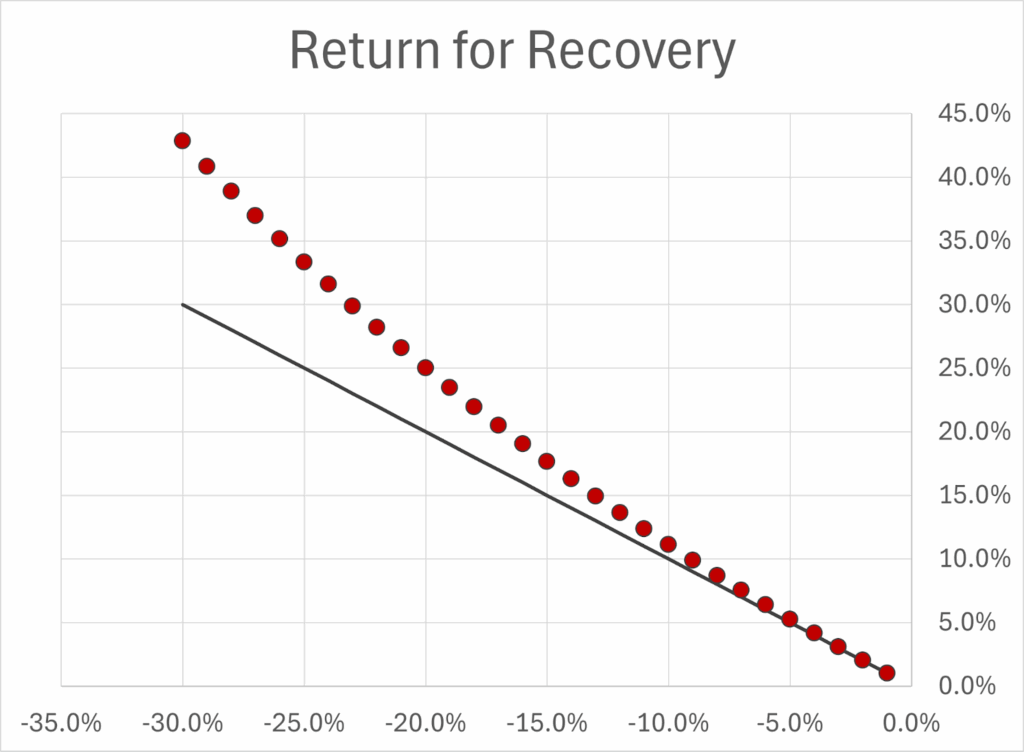

Ideally we would like the needed recovery to be equal to the black line: a loss is recovered by an equal gain. In reality the higher the loss, the exponentially larger a return you need to recover from it. Let’s zoom on smaller losses.

We see that up to more or less -10% loss the divergence is negligible: you can recover with a return of pretty much the same size of the loss. At -30% we need a 43% return to recover, 13% more!

A sustainable portfolio should very rarely encounter drawdowns of -30%, and almost never go below -50%.

👉 You can visualize this easily in Fincanva’s portfolio metrics dashboard.

This is why professional investors always look at drawdowns and volatility alongside returns. It’s not about being cautious, it’s about staying alive long enough to compound.

Return vs Sustainability in Investing: Finding the Balance

So how do you find the balance? You need to stop asking only:

- “What’s the return?”

And start asking:

- “What’s the maximum drawdown?”

- “How volatile is this portfolio?”

- “Is the return worth the risk?”

- “How does it behave across different market conditions?”

That’s the real test of an investment idea.

How Fincanva Helps

This is exactly the kind of question Fincanva was built to answer.

On our platform you can:

- Simulate portfolios with different allocations.

- Stress-test ideas against history, volatility, and drawdowns.

- Compare return vs sustainability side by side, before risking a single dollar.

Instead of blindly chasing what’s hot, you can actually see how an idea might behave in good times and bad. With a few clicks in Fincanva, you can see exactly how your portfolio might have behaved in 2008, during COVID, or in the inflation shock of 2022.

That’s how you move from gambling to investing.

In the next articles we will discover how to create sustainable portfolios that meet your investment goals.

👉 On our platform you can simulate portfolios, stress-test ideas, and compare results. Try building your first model in the Fincanva Screener or create a custom portfolio now.

Final Thought

Chasing returns is like sprinting after a fast car: exciting, but often reckless. Sustainable investing is slower, steadier, and far more powerful in the long run.

Next time you’re tempted by the latest “can’t-miss” idea, pause and ask: “Am I looking at returns, or at sustainability?”With Fincanva, you don’t have to guess, you can test it, see it, and decide with clarity.